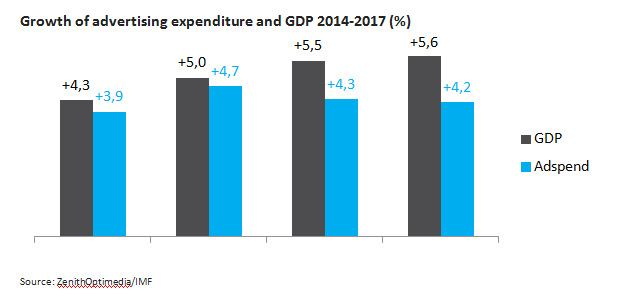

ZenithOptimedia predicts global ad expenditure will grow 4.4 % in 2015, reaching US$544 billion by the end of the year.

Our forecast for 2015 is down (by 0.5 percentage points), mainly because of the severe economic problems in Russia, Ukraine and Belarus, and a slowdown in China, which is now so large that relatively small changes in growth visibly affect the global total.

Growth of advertising expenditure and GDP 2014-2017 (%)

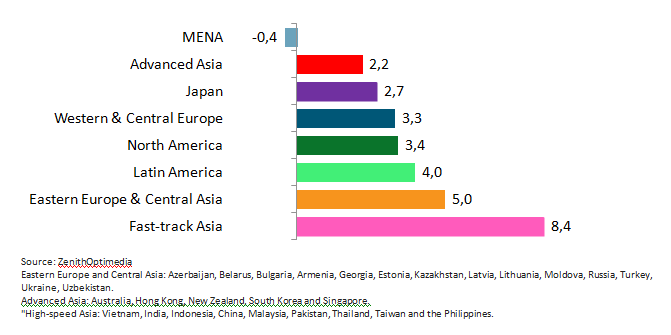

Forecast by regional bloc

The conflict in Ukraine severely disrupted the domestic ad market, while Russia has suffered from sanctions imposed by the US and the EU, the sanctions it imposed in response, and a withdrawal of international investment. These shocks have been exacerbated by a sharp drop in the price of oil, which accounts for 70% of Russia’s exports, and devaluation of the Ukrainian and Russian currencies. These problems have since spread to Belarus, whose main trading partner is Russia by some distance. We forecast adspend in Ukraine to shrink 62.3 % this year, on top of a 51.2 % decline in 2014. Russian adspend grew just 4.3 % in 2014, which was the first year of growth below double-digit rates since 2009, and we expect the market to shrink by 16.5 % in 2015. We forecast a 33.5 % decline in adspend in Belarus this year, following 7.6 % growth in 2014.

However, we expect to see the growth to 5.3 % next year thanks to the Olympic games in Rio de Janeiro and the presidential elections in the USA.

Looking back over the past two decades can be stated that global figures are still above average for the last 20 years (4.2 %) and significantly better than the average in the last decade (2,8%).

Growth in adspend by regional bloc 2014-2015 (%)

We expect growth in the UK and the peripheral Eurozone markets to counterbalance the weakness in the core Eurozone, allowing Western & Central Europe to grow at an average of 2.8% a year between 2014 and 2017.

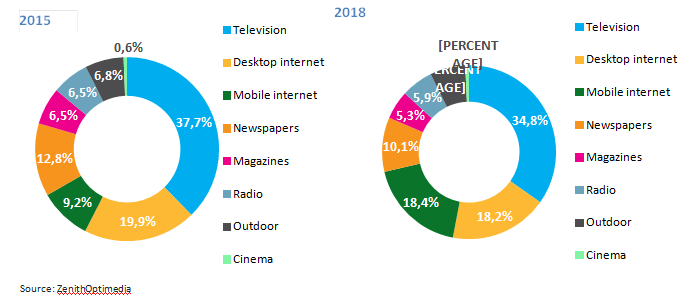

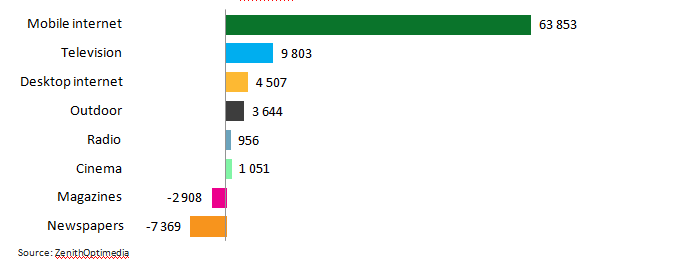

Global advertising expenditure by medium

Mobile is now the main driver of global adspend growth. We forecast mobile to contribute 62% of all the extra adspend between 2014 and 2017 (again excluding markets where we don’t have a breakdown by medium). Television will be the second-largest contributor (accounting for 23% of new ad expenditure), followed by desktop internet (18%). The gains made by outdoor, radio and cinema will be cancelled out by the continued decline of newspapers and magazines, which we expect to shrink by a combined US$9 billion over the forecast period.

Contribution to global growth in adspend by medium 2014-2017 (US$ million)

The internet is still the fastest growing medium by some distance. We estimate it grew 18.5% in 2014, and we forecast an average of 14% annual growth between 2014 and 2017.

Improved advertising formats are making internet display more interactive and attention-grabbing. Online video is also benefiting from the explosion of mobile video consumption. Smartphones have bigger and better displays, and transmission technologies like 4G are improving connection speeds, making it possible for consumers to watch high-quality video content wherever and whenever they choose. Online video is now growing faster than any other digital category or sub-category – it grew 34% in 2014, and we forecast it to grow at 29% a year for the rest of our forecast period. Meanwhile social media has embraced the opportunities offered by the transition to mobile, integrating advertising seamlessly into the flow of social content, and is growing at 25% a year.

Television is still by some distance the dominant advertising medium, attracting 39% of spend in 2014. Television offers unparalleled capacity to build reach, and establish brand awareness and associations. We forecast television adspend to grow by an average of 3% a year through to 2017.

Despite this healthy growth, television’s share of global adspend is likely to fall back slightly over the next few years as desktop and mobile internet grow much faster. Television’s market share has grown steadily over the last three and a half decades, from 29.9% of spend in 1980 to 39.7% in 2013. We think it has now peaked, however; we estimate that television’s share slipped slightly to 39.4% in 2014 and forecast it to fall further to 37.3% in 2017. Marketers are also beginning to move small budgets away from television to online video, which we expect to grow from 2.1% of global adspend in 2014 to 3.9% in 2017. The audiovisual share of the market will therefore fall by only 0.3 percentage points, from 41.5% in 2014 to 41.2% in 2017.

Share of global adspend by medium (%)